Networth with Direct Connect

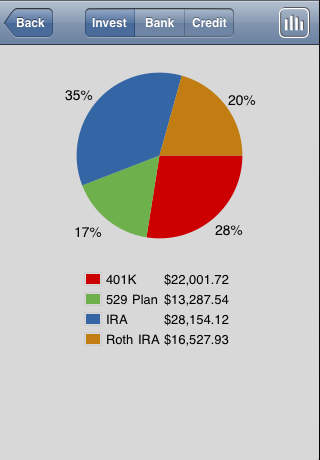

Networth with Direct Connect helps you track all your finances in a single application. This application connects directly to your investment, bank, and credit card accounts, and instantly downloads account balances and transaction details. You can graphically track how your networth changes over time, and see pie/bar chart breakdown of your account balances and portfolio holdings.

Networth stores all of your usernames and passwords entirely within your device in a secure, encrypted database using AES 256 bit encryption. While other applications offering similar function require you to go through their website, and store your usernames and passwords on their web-site backend, Networth stores all information within your device, and makes direct connections to financial institutions servers.

HOW IT WORKS?

Networth uses the OFX DirectConnect protocol supported by hundreds of brokerages, banks and credit card institutions to pull account balances and transaction details into your device. Your device makes a direct network connection to financial institutions servers, and downloads your account information without going through any intermediate web service/site. Your username/password information stays entirely within your device at all times. All information on the device is stored encrypted using AES 256 bit encryption, and hence your data stays protected even in case of device loss or theft.

GETTING STARTED

To get started, simply create your Investment, Bank and Credit Card accounts in the application. For each account, give a name, a category, and then link the account to your institution by selecting from the list of financial institutions. When you enter the username/password for the institution, Networth will validate the information by connecting to the financial institutions servers, pull the list of accounts, and offer you a choice to select the account in case you have multiple accounts at the same institution. When you save the account, all your access information is stored in the secure database. From this point onwards, with the single tap on the Refresh button, you can get instant balance information and transaction details.

For investment accounts, in addition to account balances, Networth will show your holdings in terms of cash, stocks, mutual funds, options, etc. For bank and credit card accounts, Networth will show the list of transactions in the last month. For credit cards, Networth will also present details on payment due date, minimum payment, and available credit, when this information is made available by the financial institution.

The name and category you assign to an account can be anything you like. The category names simply allow you to group your accounts the way you like. Typical categories names are: 401K, IRA, Education, Checking, Savings, Master Card, Visa, etc.

FEATURES

✔ Instantly downloads balances and transaction details for your investment, bank and credit card accounts

✔ All data stored entirely within your device in a secure database protected by AES 256 bit encryption. No website involved that stores your usernames and passwords

✔ Simple, intuitive user interface

✔ Trend chart to show how your investment+bank and credit card balances change over time

✔ Pie/Bar charts to show breakdown of account balances in various categories

✔ Pie/Bar charts to show breakdown of holdings in an account

✔ Ability to email a report

✔ Multi-currency support. Accounts can each be in a different currency

✔ Ability to configure the transaction download period

✔ All communication with the financial institutions servers is over SSL, the same protocol used for financial transactions over the web

✔ Every access to the app requires you to enter the password. Also, all account data is reset after 5 failed password attempts

Visit http://www.anishu.com for the list of institutions and additional screenshots.